Mannheim, December 21, 2023

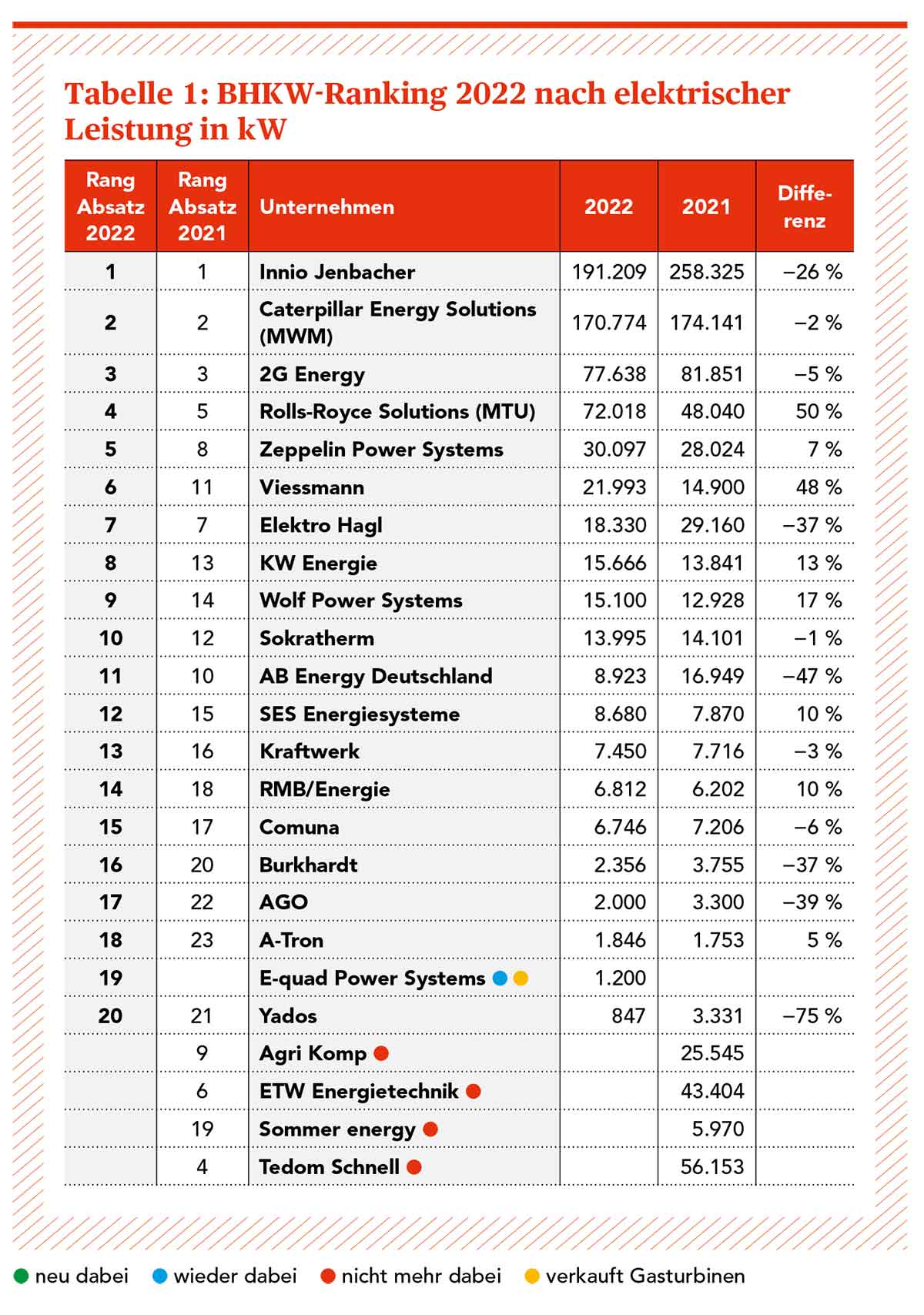

The cogeneration power plant ranking of “Energie & Management” magazine for 2022 (issue 11/2023) reveals opposing trends for companies’ domestic and international performance. With its MWM brand, Caterpillar Energy Solutions stands out with high exports. With an electrical output of about 171 MWel, the Mannheim-based engineering company—which delivers highly efficient solutions for decentralized energy generation—again came second in the 2022 ranking, as in 2021.

Institute for Applied Ecology Surveys 19 Engine Manufacturers and One Gas Turbine Manufacturer

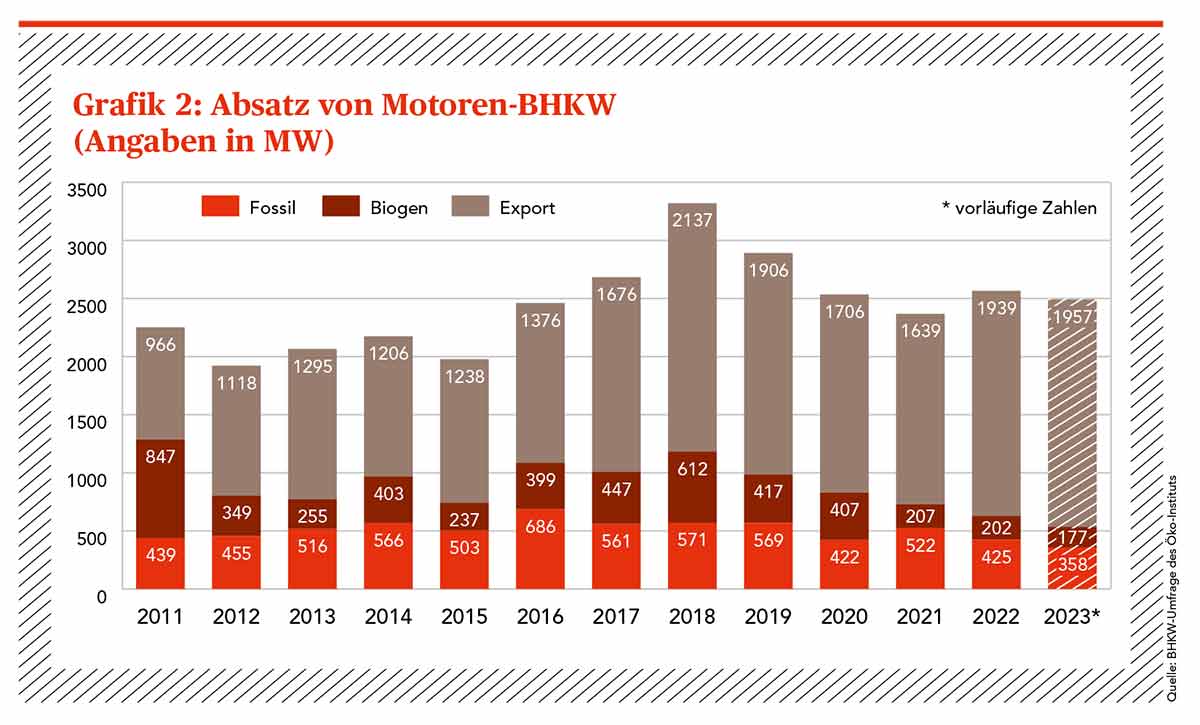

According to the findings of the Institute for Applied Ecology, domestic sales of cogeneration power plants are down compared to 2021, while exports have returned to pre-pandemic levels. The survey of the Institute for Applied Ecology, in which 20 manufacturers took part, provided comprehensive insights into the market and qualitative data that went beyond purely statistical evaluations such as the market master data register.

The companies were asked about various parameters, including their revenue, the number and output of plants sold, and preferred fuels. Interestingly, 19 of the 20 participants were manufacturers of cogeneration power plant engines. For the first time since 2019, one gas turbine manufacturer was also represented. However, four manufacturers who had taken part in last year’s survey did not take part this year. The Institute for Applied Ecology estimated the current sales figures for these manufacturers on the basis of the average market development.

Against this backdrop, Caterpillar Energy Solutions stands out with its high exports and challenging domestic demand. While the domestic market is declining, the company has seen a remarkable rebound of exports to pre-pandemic levels. From these facts, the Institute for Applied Ecology draws the conclusion that the success in the international market can mean an important strategic positioning and diversification of sales markets for Caterpillar Energy Solutions in order to compensate for the challenging domestic demand situation.

More Comprehensive Picture of the Cogeneration Markets

At 202 MWel, sales of cogeneration power plants that run on biogenic fuels remained roughly the same as in the previous year. On the other hand, sales of fossil fuel-fired plants fell by 100 MWel to 425 MWel.

According to quantitative estimates, this development is not linked to the four manufacturers that no longer participate. On the other hand, the sales markets for exports have recovered to the level prior to the coronavirus crisis in 2020.

For the coming year 2024, 56 percent of the manufacturers surveyed expect the demand in the German sales market to decline, while 22 percent believe that the demand will remain the same or increase.

Cogeneration power plant and engine manufacturers attribute the restrained domestic demand to the lack of planning certainty, particularly due to the revision of the German Building Energy Act (GEG). The discussion about this has led to a great deal of uncertainty. Thus, customers prefer to wait and see what exactly the law will look like.

An analysis of the output classes draws attention to an interesting development: Though the total output sold for biogenic plants remained the same in 2022, there was a clearly visible shift from medium-sized to large plants. Sales in the output class of 150 kWel to 500 kWel fell by 69 percent from 101 MWel to 32 MWel. At the same time, however, sales in the output class above 500 kWel skyrocketed by 70 percent from 93 MWel to 158 MWel.

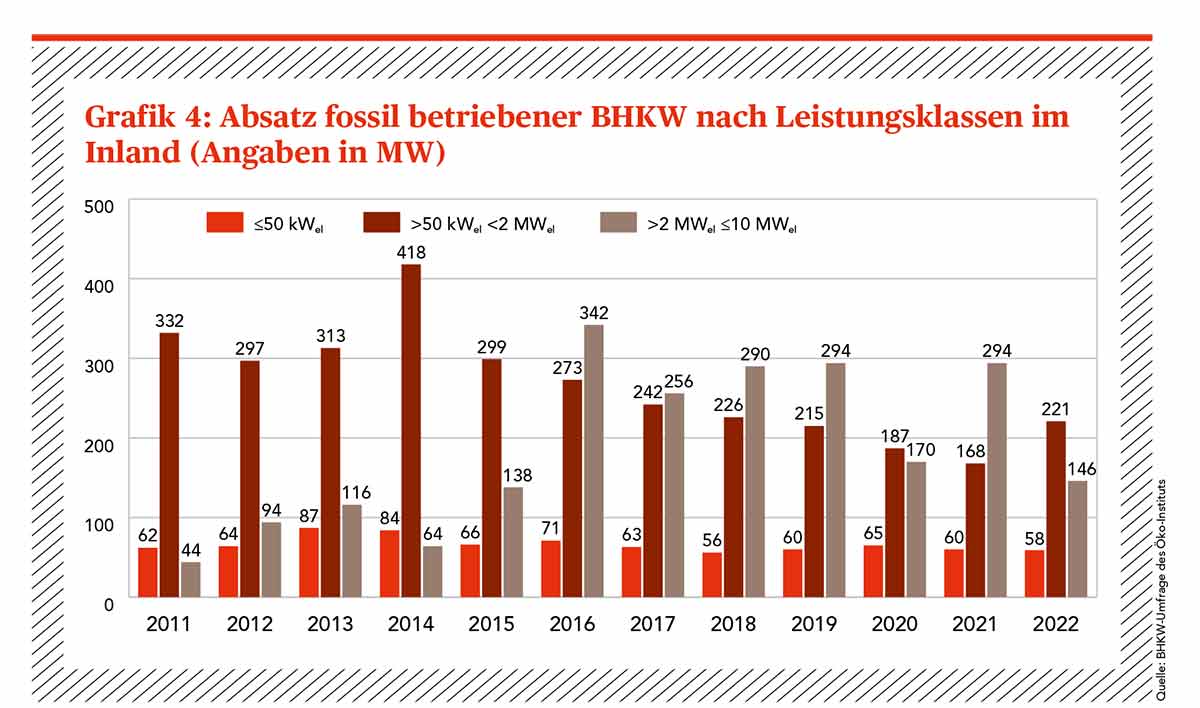

For plants running on fossil fuels, the situation was the other way around (see chart 4). Here, sales in the medium output class from 50 kWel to 2 MWel increased by 32 percent to 221 MWel, while in the segment of large plants, it slumped by 50 percent.

One current problem mentioned by the manufacturers surveyed is the supply chain issue, especially in connection with electronic components with long delivery times. The shortage of skilled personnel also remains an issue for many companies, though it is less severe that in the previous year. Some companies are experiencing capacity bottlenecks, though this challenge lies more in the assembly and maintenance of the plants than in the production itself.

Future of Combined Heat and Power (CHP) Technology Overshadowed by Uncertainties in the Domestic Market

The experts of the Institute for Applied Ecology predict that the future of combined heat and power (CHP) technology will continue to be overshadowed by uncertainties in the domestic market, particularly due to amendments to the law and the resulting customer uncertainty.

The shift toward larger plants running on biogenic fuels and toward medium-sized plants running on fossil fuels could indicate a change in customer needs or requirements. The challenges in the supply chain and the shortage of skilled personnel could impact the industry, but it appears that companies are making adjustments to address these challenges.

The cogeneration power plant market in Germany showed little momentum, with fewer gas engines sold in the German market than in 2021. There has been a decline in both fossil and biogenic plants. The average module output of many suppliers is trending slightly downward, though some companies have recorded an increase.

In the ranking by electrical output sold, the leading manufacturers have hardly changed compared to the previous year. Companies such as Innio Jenbacher, Caterpillar Energy Solutions, and 2G Energy have retained their leading positions, while Rolls-Royce stands out with impressive growth.

There is also growing demand for plants that support the use of hydrogen. The possibility of retrofitting natural gas-fired plants for operation with hydrogen is becoming increasingly important and is already being considered by numerous manufacturers.

The report of the Institute for Applied Ecology also highlights the importance of combined heat and power technology as an efficient building block for covering residual loads and emphasizes the role of CHP plants as a backup for energy supply security, especially in the context of the ongoing expansion of renewable energies.